UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2020

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

.

Commission File Number 001-07845

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of principal executive offices) | (Zip code) | ||||||||||

Registrant’s telephone number, including area code: (417 ) 358-8131

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class | Trading Symbol | Name of each exchange on which registered | ||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant (based on the closing price of our common stock on the New York Stock Exchange) on June 30, 2020 was $4,552,973,000 .

There were 132,987,415 shares of the registrant’s common stock outstanding as of February 16, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

Part of Item 10, and all of Items 11, 12, 13, and 14 of Part III, are incorporated by reference from the Company’s definitive Proxy Statement for the Annual Meeting of Shareholders to be held on May 25, 2021.

TABLE OF CONTENTS

LEGGETT & PLATT, INCORPORATED—FORM 10-K

FOR THE YEAR ENDED December 31, 2020

Page Number | ||||||||

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Supp. Item. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

Forward-Looking Statements

This Annual Report on Form 10-K and our other public disclosures, whether written or oral, may contain “forward-looking” statements including, but not limited to: the profitable growth and operating performance of the Company; projections of Company revenue, income, earnings, capital expenditures, dividends, capital structure, cash from operations, cash repatriation, restructuring-related costs, tax impacts or other financial items, effective tax rate; maintenance of indebtedness under the commercial paper program; litigation exposure; LIFO reserve; our ability to deleverage; possible plans, goals, objectives, prospects, strategies, or trends concerning future operations; statements concerning future economic performance, possible goodwill or other asset impairment; access to liquidity; compliance with the debt covenant requirements; amount of fixed cost savings; raw material availability and pricing; supply chain disruptions; labor; nonwoven fabric, microchips, and chemical shortages; employee termination costs; and the underlying assumptions relating to the forward-looking statements. These statements are identified either by the context in which they appear or by use of words such as “anticipate,” “believe,” “estimate,” “expect,” “guidance,” “intend,” “may,” “plan,” “project,” “should,” or the like. All such forward-looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described in this provision.

Any forward-looking statement reflects only the beliefs of the Company or its management at the time the statement is made. Because all forward-looking statements deal with the future, they are subject to risks, uncertainties, and developments which might cause actual events or results to differ materially from those envisioned or reflected in any forward-looking statement. Moreover, we do not have, and do not undertake, any duty to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement was made. For all of these reasons, forward-looking statements should not be relied upon as a prediction of actual future events, objectives, strategies, trends, or results.

Readers should review Item 1A Risk Factors in this Form 10-K for a description of important factors that could cause actual events or results to differ materially from forward-looking statements. It is not possible to anticipate and list all risks, uncertainties, and developments which may affect our future operations or our performance, or which otherwise may cause actual events or results to differ materially from forward-looking statements. However, the known material risks and uncertainties include the following:

•the ongoing adverse impact on our trade sales, earnings, liquidity, cash flow, and financial condition caused by the COVID-19 pandemic which has had and, depending on the length and severity of the pandemic and the timing and effectiveness of any vaccines, could continue, in varying degrees, to materially negatively impact, among other things (i) the demand for our products and our customers’ products, growth rates in the industries in which we participate, and opportunities in those industries; (ii) our manufacturing facilities’ ability to remain open, or fully operational, obtain necessary raw materials and parts, maintain appropriate labor levels, and ship finished products to customers; (iii) operating costs related to pay and benefits for our terminated employees; (iv) our ability to collect trade and other notes receivables in accordance with their terms due to customer bankruptcy, financial difficulties or insolvency; (v) impairment of goodwill and long-lived assets; (vi) restructuring and related costs; and (vii) our ability to borrow under our revolving credit facility, including our ability to comply with the restrictive covenants in our credit facility that may limit our operational flexibility and our ability to pay our debt when it comes due;

•inability to “deleverage” after the ECS acquisition in the expected timeframe, due to increases or decreases in our capital needs, which may vary depending on a variety of factors, including, without limitation, demand for our products, cash flow, any acquisition or divestiture activity, our working capital needs, and capital expenditures;

•our ability to manage working capital;

•adverse changes in consumer confidence, housing turnover, employment levels, interest rates, trends in capital spending, and the like;

•factors that could impact raw materials and other costs, including the availability and pricing of steel scrap and rod, chemicals, nonwoven fabrics, microchips, the availability of labor, wage rates, and energy costs;

•our ability to pass along raw material cost increases through increased selling prices;

•price and product competition from foreign (particularly Asian and European) and domestic competitors;

•our ability to maintain profit margins if our customers change the quantity and mix of our components in their finished goods;

•our ability to access the commercial paper market;

•the speed at which vaccines for the COVID-19 virus are administered, the percentage of the population vaccinated, and the effectiveness of those vaccines;

1

•our ability to maintain and grow the profitability of acquired companies;

•adverse changes in political risk, and U.S. or foreign laws, regulations, or legal systems (including tax law changes);

•cash generation sufficient to pay the dividend;

•our ability to realize deferred tax assets on our balance sheet;

•cash repatriation from offshore accounts;

•tariffs imposed by the U.S. government that result in increased costs of imported raw materials and products that we purchase;

•our ability to maintain the proper functioning of our internal business processes and information systems through technology failures or otherwise;

•our ability to avoid modification or interruption of our information systems through cybersecurity breaches;

•the loss of business with one or more of our significant customers;

•our ability to comply with environmental, social, and governance responsibilities;

•litigation risks related to various contingencies including antitrust, intellectual property, contract disputes, product liability and warranty, taxation, environmental, and workers’ compensation expense;

•our borrowing costs and access to liquidity resulting from credit rating changes;

•business disruptions to our steel rod mill;

•risks related to operating in foreign countries, including, without limitation, credit risks, ability to enforce intellectual property rights, currency exchange rate fluctuations, industry labor strikes, increased customs and shipping rates, inconsistent interpretation, and enforcement of foreign laws;

•risks relating to the United Kingdom’s exit from the European Union (commonly known as “Brexit”);

•the continued effectiveness and enforcement of anti-dumping and countervailing duties on the import of innersprings and finished mattresses;

•our ability to realize gain from the sale of real estate;

•our ability to comply with privacy and data protection regulations; and

•our ability to comply with climate change laws and regulations.

2

PART I

PART I

Item 1. Business.

Summary

Leggett & Platt, Incorporated ("Leggett & Platt," "Company," "we," "us", or "our"), a pioneer of the steel coil bedspring, has become an international diversified manufacturer that conceives, designs, and produces a wide range of engineered components and products found in many homes and automobiles. As discussed below, our operations are organized into 15 business units, which are divided into seven groups under our three segments: Bedding Products; Specialized Products; and Furniture, Flooring & Textile Products.

Overview of Our Segments

Bedding Products Segment

| BEDDING GROUP | ||

| Steel Rod | ||

| Drawn Wire | ||

| U.S. Spring | ||

| Specialty Foam | ||

| Adjustable Bed | ||

| International Spring | ||

| Machinery | ||

Our Bedding Products segment has its roots in the Company's founding in 1883 with the manufacture of steel coil bedsprings. Today, we support our customers' needs from raw materials to components to finished mattresses and foundations to distribution and fulfillment. Our innerspring, specialty foam, and finished product development and production capabilities allow us to create value at each point, from raw materials all the way to private label finished goods and delivery to the consumer.

We operate a steel rod mill in the U.S. with historical annual output of about 500,000 tons. A substantial majority of that output has been used by our two U.S. wire mills that have supplied virtually all of the wire consumed by our other domestic businesses. We also supply steel rod and wire to trade customers that operate in a broad range of markets.

We are a major supplier of adjustable beds, with domestic manufacturing, distribution, e-commerce fulfillment, and global sourcing capabilities. We also produce machinery used by bedding manufacturers in the production and assembly of their finished products. Our range of products offers our customers a single source for many of their component and finished product needs.

These innovative proprietary products and our efficient and low-cost vertical integration have made us the largest U.S. manufacturer in many of these businesses. We strive to understand what drives consumer purchases in our markets and focus our product development activities on meeting end-consumer needs. We believe we attain a cost advantage from efficient manufacturing methods, internal production of key raw materials, large-scale production, and purchasing leverage. Sourcing components and finished products from us allows our customers to focus on designing, merchandising, and marketing their products.

3

PART I

PRODUCTS

Bedding Group

| • | Steel rod | ||||||||||

| • | Drawn wire | ||||||||||

| • | Specialty foam chemicals and additives | ||||||||||

| • | Innersprings (sets of steel coils, bound together, that form the core of a mattress) | ||||||||||

| • | Proprietary specialty foam for use primarily in bedding and furniture | ||||||||||

| • | Private label finished mattresses, often sold compressed and boxed | ||||||||||

| • | Ready-to-assemble mattress foundations | ||||||||||

| • | Wire forms for mattress foundations | ||||||||||

| • | Adjustable beds | ||||||||||

| • | Machines that we use to shape wire into various types of innersprings | ||||||||||

| • | Industrial sewing and quilting machines | ||||||||||

| • | Mattress-packaging and glue-drying equipment | ||||||||||

CUSTOMERS

| • | We used about 70% of our wire output to manufacture our own products in 2020, with the majority going to our U.S. innerspring operations | ||||||||||

| • | Various industrial users of steel rod and wire | ||||||||||

| • | Manufacturers of finished bedding (mattresses and foundations) | ||||||||||

| • | Bedding brands and mattress retailers | ||||||||||

| • | E-commerce retailers | ||||||||||

| • | Big box retailers, department stores, and home improvement centers | ||||||||||

Specialized Products Segment

| AUTOMOTIVE GROUP | ||

| Automotive | ||

| AEROSPACE PRODUCTS GROUP | ||

| Aerospace Products | ||

| HYDRAULIC CYLINDERS GROUP | ||

| Hydraulic Cylinders | ||

Our Specialized Products segment designs, manufactures, and sells products including automotive comfort and convenience systems, tubing and fabricated assemblies for the aerospace industry, and hydraulic cylinders for the material handling, construction, and transportation industries. In our Automotive business, our technical capability and deep customer engagement allows us to compete on critical functionality, such as comfort, size, weight, and noise. We believe our reliable product development and launch capability, coupled with our global footprint, makes us a trusted partner for our Tier 1 and Original Equipment Manufacturer (OEM) customers.

4

PART I

PRODUCTS

Automotive Group

| • | Mechanical and pneumatic lumbar support and massage systems for automotive seating | ||||||||||

| • | Seat suspension systems | ||||||||||

| • | Motors and actuators, used in a wide variety of vehicle power features | ||||||||||

| • | Cables | ||||||||||

Aerospace Products Group

| • | Titanium, nickel and stainless-steel tubing, formed tube, tube assemblies, and flexible joint components, primarily used in fluid conveyance systems | ||||||||||

Hydraulic Cylinders Group

| • | Engineered hydraulic cylinders | ||||||||||

CUSTOMERS

| • | Automobile OEMs and Tier 1 suppliers | ||||||||||

| • | Aerospace OEMs and suppliers | ||||||||||

| • | Mobile equipment OEMs, primarily serving material handling and construction markets | ||||||||||

Furniture, Flooring & Textile Products Segment

| HOME FURNITURE GROUP | ||

| Home Furniture | ||

| WORK FURNITURE GROUP | ||

| Work Furniture | ||

| FLOORING & TEXTILE PRODUCTS GROUP | ||

| Flooring Products | ||

| Fabric Converting | ||

| Geo Components | ||

In our Furniture, Flooring & Textile Products segment, we design, manufacture, and distribute a wide range of components and finished products for residential and commercial markets, and select markets for structural fabrics and geo components. We supply components used by home and work furniture manufacturers to provide comfort, motion, and style in their finished products, as well as select lines of private label finished furniture. We also produce or distribute carpet cushion and hard surface flooring underlayment, as well as fabrics and geo components used in a variety of applications.

5

PART I

PRODUCTS

Home Furniture Group

| • | Steel mechanisms and motion hardware (enabling furniture to recline, tilt, swivel, rock, and elevate) for reclining chairs, sofas, sleeper sofas, and lift chairs | ||||||||||

| • | Springs and seat suspensions for chairs, sofas, and loveseats | ||||||||||

Work Furniture Group

| • | Components and private label finished goods for collaborative soft seating | ||||||||||

| • | Bases, columns, back rests, casters, and frames for office chairs, and control devices that allow chairs to tilt, swivel, and elevate | ||||||||||

Flooring & Textile Products Group

| • | Carpet cushion and hard surface flooring underlayment (made from bonded scrap foam, fiber, rubber, and prime foam) | ||||||||||

| • | Structural fabrics for mattresses, residential furniture, and industrial uses | ||||||||||

| • | Geo components (synthetic fabrics and various other products used in ground stabilization, drainage protection, erosion, and weed control) | ||||||||||

CUSTOMERS

| • | Manufacturers of upholstered furniture | ||||||||||

| • | Office furniture manufacturers | ||||||||||

| • | Flooring retailers and distributors, including big box retailers and home improvement centers | ||||||||||

| • | Contractors, landscapers, road construction companies, retailers, and government agencies using or selling geo components | ||||||||||

| • | Mattress and furniture producers and manufacturers of packaging, filtration, and draperies | ||||||||||

6

PART I

Revised Segment Structure

Our operations are comprised of 132 manufacturing facilities located in 17 countries around the world. Our reportable segments are the same as our operating segments, which also correspond with our management organizational structure. To reflect how we manage our businesses, and in conjunction with the change in executive officer leadership, our management organizational structure and all related internal reporting changed effective January 1, 2020. As a result, our segment reporting changed to reflect the new structure. These segment changes are retrospectively applied to all prior periods presented. The modified structure consists of three segments, seven business groups, and 15 business units organized as follows:

Bedding Products Segment 1 | Specialized Products Segment 2 | Furniture, Flooring & Textile Products Segment 3 | ||||||||||||

| BEDDING GROUP | AUTOMOTIVE GROUP | HOME FURNITURE GROUP | ||||||||||||

| Steel Rod | Automotive | Home Furniture | ||||||||||||

| Drawn Wire | ||||||||||||||

| U.S. Spring | AEROSPACE PRODUCTS GROUP | WORK FURNITURE GROUP | ||||||||||||

| Specialty Foam | Aerospace Products | Work Furniture | ||||||||||||

| Adjustable Bed | ||||||||||||||

| International Spring | HYDRAULIC CYLINDERS | FLOORING & TEXTILE | ||||||||||||

| Machinery | GROUP | PRODUCTS GROUP | ||||||||||||

| Hydraulic Cylinders | Flooring Products | |||||||||||||

| Fabric Converting | ||||||||||||||

| Geo Components | ||||||||||||||

1 The new segment consists of the former Residential Products and Industrial Products segments, plus the former Consumer Products Group (which is renamed the Adjustable Bed business unit), minus the former Fabric & Flooring Products Group (which is renamed the Flooring & Textile Products Group). The Bedding Products Segment generated 48% of our trade sales during 2020.

2 The Specialized Products segment generated 21% of our trade sales during 2020.

3 The new segment consists of the former Furniture Products segment, plus the former Fabric & Flooring Products Group (which is renamed the Flooring & Textile Products Group) minus the former Consumer Products Group (which is renamed the Adjustable Bed business unit). The Furniture, Flooring & Textile Products Segment generated 31% of our trade sales in 2020.

Strategic Priorities

Primary Financial Metric

Total Shareholder Return (TSR), relative to peer companies, is a primary financial measure that we use to assess long-term performance. TSR = (Change in Stock Price + Dividends)/Beginning Stock Price. Our goal is to achieve TSR in the top third of the S&P 500 companies over rolling three-year periods through an approach that employs four TSR drivers: revenue growth, margin expansion, dividends, and share repurchases.

Our incentive programs reward return and cash generation, and profitable growth. Senior executives participate in a TSR-based incentive program (based on our performance compared to a group of approximately 300 peers). For information about our TSR targets, see the discussion under "Total Shareholder Return" in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations on page 34.

7

PART I

Disciplined Growth

The expected long-term contribution to TSR from revenue growth is 6-9%. From 2018 to 2020, we generated combined unit volume and acquisition growth of 2% per year on average. We also benefited slightly from commodity inflation, resulting in total revenue growth of 3% per year on average.

We will continue to make investments to support expansion in current businesses and product lines where sales are growing profitably. We also envision periodic acquisitions that add capabilities in these businesses or provide opportunities to enter more diverse, faster-growing, and higher margin markets. We expect all acquisitions to have a clear strategic rationale, a sustainable competitive advantage, a strong fit with the Company, and be in attractive and growing markets.

Returning Cash to Shareholders

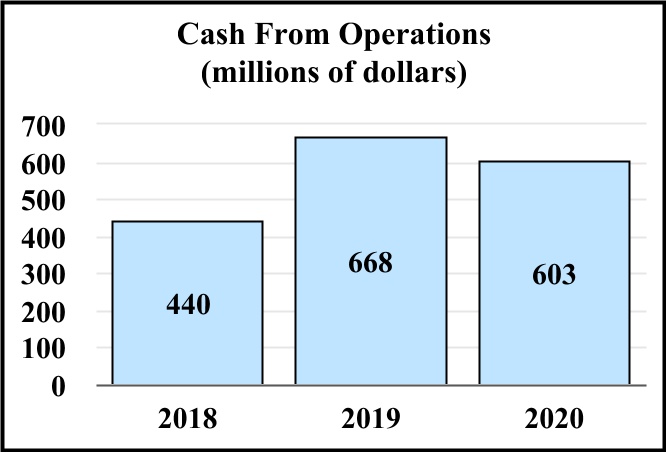

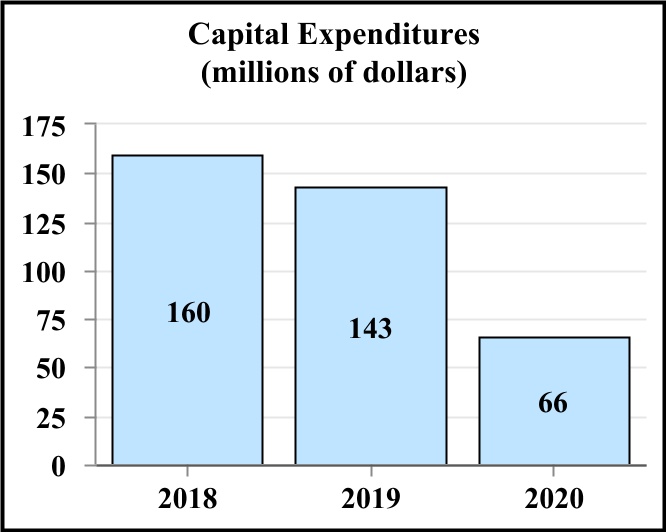

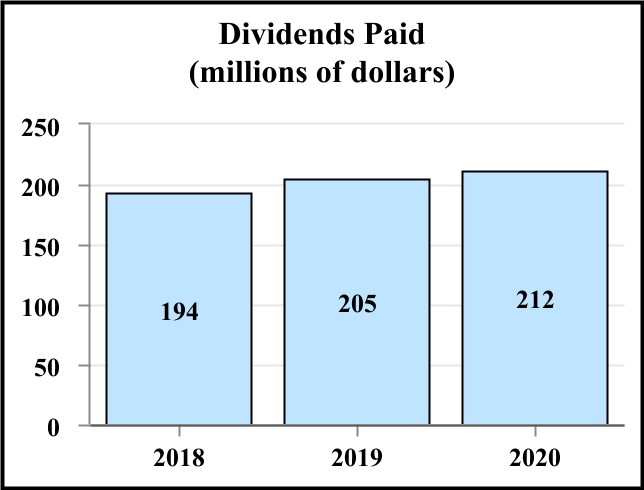

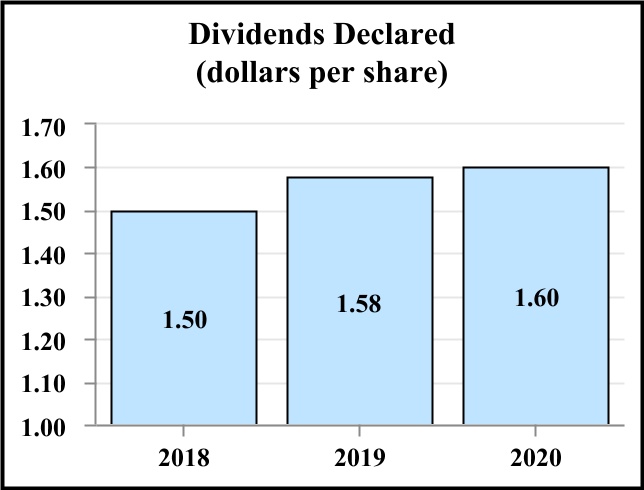

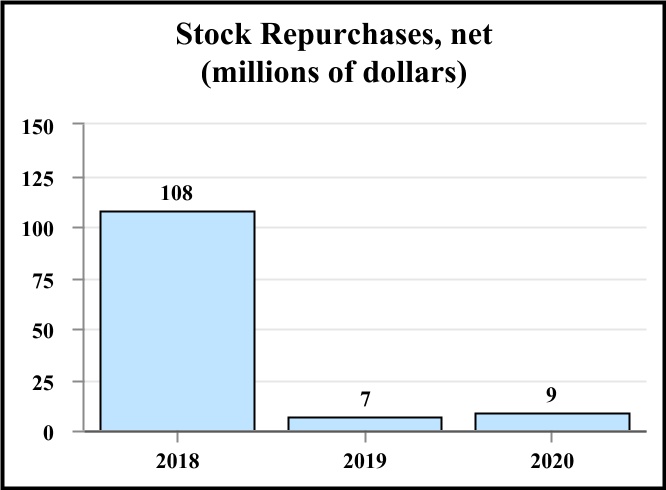

From 2018 to 2020, we generated $1.71 billion of operating cash, and we returned much of this cash to shareholders in the form of dividends ($610 million) and share repurchases ($139 million). Our top priorities for use of cash are organic growth (capital expenditures), dividends, and strategic acquisitions. Historically, after funding those priorities, we generally repurchased stock with remaining available cash. Currently, because of the debt level increases in connection with the ECS acquisition in early 2019, we have and expect to continue to focus instead on deleveraging by temporarily limiting share repurchases, controlling the pace of acquisition spending, and using operating cash flow to repay debt.

For information about dividends and share repurchases, see the discussion under "Pay Dividends" and "Repurchase Stock" in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations beginning on page 53.

2020 Market Volatility Challenges and Our Response

The impact of the COVID-19 pandemic began in January 2020, directly affecting our operations in China, as well as the global supply chain. The crisis accelerated, impacting virtually all geographies by mid-March. We took action to:

•Implement comprehensive safety protocols,

•Monitor and manage supply chain risks,

•Align our variable cost structure to demand levels,

•Significantly reduce fixed costs and cut capital expenditures,

•Prioritize accounts receivable collections and inventory management, and

•Amend the financial covenant in our revolving credit facility to provide additional liquidity.

These efforts helped to strengthen cash flow and protect our balance sheet as we moved through the year. By mid-second quarter 2020, we began to see rapid recovery in businesses serving home-related markets. With consumers spending less on travel and entertainment, they began investing more in their homes. This benefited our Bedding, Home Furniture, Flooring, and Textiles businesses.

In addition, the long-term trends in the bedding market that led us to acquire Elite Comfort Solutions (ECS) in early 2019 accelerated as a result of the pandemic. Consumers have increasingly purchased compressed mattresses, including hybrids, online and through various retail channels. Because of ECS, we have benefited from this shift to an omni-channel environment.

As demand recovered in Bedding in the third quarter of 2020, we began to face global constraints.

•Nonwoven fabrics used in the production of ComfortCore® innersprings were diverted into use for face masks, hospital gowns, and other personal protective equipment.

•Labor availability was impacted by the pandemic itself, as well as government restrictions and relief programs. Labor issues were amplified by the rapid change in our production needs. Our operations shifted from a near shutdown in early April to customer demand in excess of pre-pandemic levels in a matter of weeks across many of our businesses.

8

PART I

•Chemical shortages emerged as producers of the chemicals used to make foam were impacted by tropical storms and hurricanes and reported a variety of equipment and production issues.

We made progress on both the nonwoven fabrics and labor shortages as we moved through 2020. Chemical shortages are ongoing and are expected to continue through at least mid-2021.

As sales recovered in the third and fourth quarters of 2020, we maintained most of the fixed cost reductions, adding costs only to support higher volumes and future growth opportunities. Margins benefited from this cost discipline. We ended the year with fixed cost savings of approximately $90 million.

For more information regarding the impact of COVID-19 on our business, refer to "COVID-19 Impacts on our Business" in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations beginning on page 35.

Acquisitions

2020

There were no acquisitions of businesses in 2020. However, we paid approximately $8 million of additional consideration associated with an upholstered office furniture business in Poland acquired in a prior year.

2019

In January 2019, we completed the acquisition of ECS for cash consideration of approximately $1.25 billion. ECS is a leader in proprietary specialized foam technology, primarily for the bedding and furniture industries. ECS operates a vertically-integrated model, developing many of the chemicals and additives used in foam production, producing specialty foam, and manufacturing private label finished products. These innovative specialty foam products include finished mattresses sold through both traditional and online channels, mattress components, mattress toppers and pillows, and furniture foams. ECS operates within the Bedding Products segment.

In December 2019, we acquired a manufacturer and distributor of a wide range of geosynthetic fabrics, grids, and erosion control products for cash consideration of approximately $21 million. The acquisition is reported in our Geo Components business unit within the Furniture, Flooring & Textile Products segment.

2018

In January 2018, we acquired Precision Hydraulic Cylinders (PHC), a leading global manufacturer of engineered hydraulic cylinders primarily for the materials handling market. The total consideration paid was $87 million. PHC serves a market of mainly large OEM customers utilizing highly engineered components with long product life-cycles that represent a small part of the end product’s cost. PHC operates within the Specialized Products segment.

We also acquired two small Geo Components businesses for total consideration of $22 million. They manufacture and distribute silt fencing and home and garden products.

For more information regarding our acquisitions, please refer to Note R on page 125 of the Notes to Consolidated Financial Statements.

9

PART I

Divestitures

In 2020, we divested two small businesses in our Bedding Products segment: a specialty wire operation in our Drawn Wire business, with annual sales of $30 million, and the final operation in our former Fashion Bed business, with annual sales of $15 million. The businesses were sold for an aggregate selling price of approximately $11 million. There were no divestitures in 2019 or 2018.

Foreign Operations

The percentages of our trade sales related to products manufactured outside the United States for the previous three years were 37%, 34%, and 34% in 2018, 2019, and 2020, respectively. Sales by ECS (acquired in January 2019) are not included in the 2018 total. Substantially all ECS sales are in the United States. Our Specialized Products segment has a larger percentage of trade sales manufactured outside the United States, relative to our other two segments, which ranged between 80% and 85% over the last three years.

Our international operations are principally located in Europe, China, Canada, and Mexico. Our products in these foreign locations primarily consist of:

Europe

| • | Innersprings for mattresses | ||||

| • | Lumbar and seat suspension systems for automotive seating and actuators for automotive applications | ||||

| • | Seamless and welded tubing and fabricated assemblies for aerospace applications | ||||

| • | Select lines of private label finished furniture | ||||

| • | Machinery and equipment designed to manufacture innersprings for mattresses | ||||

China

| • | Lumbar and seat suspension systems for automotive seating | ||||

| • | Cables, motors, and actuators for automotive applications | ||||

| • | Recliner mechanisms and bases for upholstered furniture | ||||

| • | Work furniture components, including chair bases and casters | ||||

| • | Innersprings for mattresses | ||||

Canada

| • | Lumbar supports for automotive seats | ||||

| • | Fabricated wire for the furniture and automotive industries | ||||

| • | Work furniture chair controls and bases | ||||

Mexico

| • | Lumbar and seat suspension systems for automotive seating | ||||

| • | Adjustable beds | ||||

| • | Innersprings and fabricated wire for the bedding industry | ||||

| • | Select lines of private label finished furniture | ||||

10

PART I

Geographic Areas of Operation

As of December 31, 2020, we had 132 manufacturing facilities; 84 located in the U.S. and 48 located in 16 foreign countries, as shown below. We also had various sales, warehouse, and administrative facilities. However, our manufacturing plants are our most important properties.

| Bedding Products | Specialized Products | Furniture, Flooring & Textile Products | |||||||||

| North America | |||||||||||

| Canada | n | n | |||||||||

| Mexico | n | n | n | ||||||||

| United States | n | n | n | ||||||||

| Europe | |||||||||||

| Austria | n | ||||||||||

| Belgium | n | ||||||||||

| Croatia | n | ||||||||||

| Denmark | n | ||||||||||

| France | n | ||||||||||

| Hungary | n | ||||||||||

| Poland | n | ||||||||||

| Switzerland | n | ||||||||||

| United Kingdom | n | n | |||||||||

| South America | |||||||||||

| Brazil | n | ||||||||||

| Asia | |||||||||||

| China | n | n | n | ||||||||

| India | n | ||||||||||

| South Korea | n | ||||||||||

| Africa | |||||||||||

| South Africa | n | ||||||||||

11

PART I

Dependence on Market Demand for Key Product Families

Our business is dependent upon the market demand for, and continued sale of various product families. The following table shows our approximate percentage of trade sales by product family for the last three years which indicate the degree of dependence upon market demand:

| Product Families | 2020 | 2019 | 2018 | |||||||||||||||||||||||

Bedding Group 1 | 48 | % | 48 | % | 42 | % | ||||||||||||||||||||

| Flooring & Textile Products Group | 19 | 16 | 17 | |||||||||||||||||||||||

| Automotive Group | 17 | 17 | 19 | |||||||||||||||||||||||

| Home Furniture Group | 7 | 8 | 9 | |||||||||||||||||||||||

| Work Furniture Group | 5 | 6 | 7 | |||||||||||||||||||||||

| Aerospace Products Group | 2 | 3 | 4 | |||||||||||||||||||||||

Hydraulic Cylinders Group | 2 | 2 | 2 | |||||||||||||||||||||||

1 The Company acquired ECS, a leader in proprietary specialized foam technology, primarily for the bedding and furniture industries, in January 2019.

The Company does not have a material amount of sales derived from government contracts subject to renegotiation of profits or termination at the election of any government. As such, our business is not materially dependent upon governmental customers.

Sources and Availability of Raw Materials

The products we manufacture require a variety of raw materials. We believe that worldwide supply sources are readily available for all the raw materials we use, except for nonwoven fabrics, microchips, and certain chemicals as explained below. Among the most important raw materials that we use are:

| • | Various types of steel, including scrap, rod, wire, sheet, and stainless | ||||

| • | Chemicals used in foam production | ||||

| • | Foam scrap | ||||

| • | Woven and nonwoven fabrics | ||||

| • | Titanium and nickel-based alloys and other high strength metals | ||||

| • | Electronic systems | ||||

As a result of the COVD-19 pandemic, the U.S. and other governments have ordered that certain nonwoven fabrics used to produce ComfortCore® innersprings be prioritized to produce medical supplies, resulting in shortages of the fabrics for non-medical applications. These shortages and strong bedding demand have caused us temporarily to be unable to supply full industry demand for ComfortCore®. We are engaging with customers in an effort to work through these issues. The shortages have resulted in higher pricing for nonwoven fabrics. If we are unable to obtain the fabrics, cannot pass the cost along to our customers, are required to modify existing contracts to accommodate customers, or pay damage claims to customers, our results of operations may be negatively impacted.

Because of the shift of production by semiconductor microchip manufacturers to consumer electronics, such as laptops and tablets for home schooling and home offices, and away from automotive applications during the COVID-19 related automotive industry shutdowns in 2020, currently there is a shortage of microchips in the automotive industry. Our Automotive Group uses the microchips in seat comfort products, and to a lesser extent in motors and actuators. Although, to date, our Automotive Group has been able to obtain an adequate supply of microchips, we are dependent on our suppliers to deliver these microchips in accordance with our production schedule, and a shortage of the microchips can disrupt our operations and our ability to deliver products to our customers. Also, because of the industry shortage, automotive OEMs and other suppliers have not been able to secure an adequate supply of microchips, and as a result have reduced their production of automobiles or parts, which in turn has recently reduced, and may continue to reduce our sale

12

PART I

of products. If we cannot secure an adequate supply of microchips in our supply chain, and the microchips cannot be sourced from a different supplier, or the automotive OEMs and other suppliers continue to reduce their production as a result of such shortage, this may negatively impact our sales, earnings, and financial condition.

Although not directly related to the pandemic, we have experienced supply shortages with certain chemicals used in foam production. This has impacted our ability to supply specialty foam. The shortages have also resulted in higher pricing for the chemicals. If we are unable to obtain the chemicals or pass the cost along to our customers, our results of operations may be negatively impacted.

We supply our own raw materials for many of the products we make. For example, we produce steel rod that we make into steel wire, which we then use to manufacture innersprings and foundations for mattresses. We supply a substantial majority of our domestic steel rod requirements through our own rod mill. Our wire drawing mills supply nearly all of our U.S. requirements for steel wire.

Customer Concentration

We serve thousands of customers worldwide, sustaining many long-term business relationships. In 2020, our largest customer accounted for approximately 6% of our consolidated revenues. Our top 10 customers accounted for approximately 35% of these consolidated revenues. The loss of one or more of these customers could have a material adverse effect on the Company as a whole, and on the respective segment in which the customer’s sales are reported, including each of our segments.

Patents and Trademarks

As of December 31, 2020, we had 1,517 patents issued, 567 patents in process, 997 trademarks registered and 89 trademarks in process. No single patent or group of patents, or trademark or group of trademarks, is material to our operations as a whole. A significant number of our patents relate to products manufactured in each of our three segments, while over half of our trademarks relate to products manufactured by the Bedding Products segment. We do not have any patent or group of patents, the expiration of which would have a material negative effect on our results of operations or financial condition.

Our patents and trademarks include intellectual property acquired with ECS in January 2019 related to the protection of technology around various foam applications. These include specialty polyols and additives that enhance foam performance by reducing heat retention, improving durability and diminishing odor.

s

Some of our most significant trademarks include:

| • | ComfortCore®, Mira-Coil®, VertiCoil®, Quantum®, Nanocoil®, Softech®, Lura-Flex®, Superlastic® and Active Support Technology® (mattress innersprings) | ||||

| • | Energex® and Coolflow® (specialty foam products) | ||||

| • | Semi-Flex® (box spring components and foundations) | ||||

| • | Spuhl®and Fides® (mattress innerspring manufacturing machines) | ||||

| • | Wall Hugger® (recliner chair mechanisms) | ||||

| • | No-Sag® (wire forms used in seating) | ||||

| • | LPSense® (capacitive sensing) | ||||

| • | Hanes® (fabric materials) | ||||

| • | Schukra® (automotive seating products) | ||||

| • | Gribetz®and Porter® (quilting and sewing machines) | ||||

13

PART I

Product Development

One of our strongest performing product categories across the Company is ComfortCore®, our fabric-encased innerspring coils used in hybrid and other mattresses. Our ComfortCore® volume continues to grow, and represented over 60% of our U.S. innerspring units in 2020. A growing number of our ComfortCore® innersprings contain a feature we call Quantum® Edge. These are narrow-diameter, fabric-encased coils that form a perimeter around an innerspring set, replacing a rigid foam perimeter in a finished mattress. In 2020, over 50% of our ComfortCore® innersprings in the U.S. had the Quantum® Edge feature, and Quantum® Edge continues to grow.

With the January 2019 acquisition of ECS, we gained important proprietary technologies in the production of specialty foams, primarily for the bedding and furniture industries. ECS formulates many of the chemicals and additives used in foam production. These branded, specialty polyols and additives enhance foam performance by reducing heat retention, improving durability and diminishing odor. These innovations enable us to create quality mattresses that can be compressed, and we have a significant amount of intellectual property around these specialty chemical formulations.

Many of our other businesses are engaged in product development activities to protect our market position and support ongoing growth.

Human Capital Management

We understand that the Company’s long-term success depends on our ability to attract and retain diverse talent, develop that talent, and plan for future succession. We also recognize the importance of keeping our employees safe. In the following sections, we discuss our efforts to achieve these objectives.

Our Employees

Our Employees. At year-end 2020, we had approximately 20,400 employees, of which 15,100 were engaged in production and 11,400 were international employees (including 5,700 in Asia and 2,600 in Europe). Of these employees, 7,100 were in Bedding Products, 7,700 were in Specialized Products, and 4,800 were in Furniture, Flooring & Textile Products, with the remainder at our corporate office or in other roles. At year-end 2019, we had approximately 22,000 employees.

Collective Bargaining. At year-end 2020, 17% of our employees were represented by labor unions that collectively bargain for work conditions, wages, or other issues. We did not experience any material work stoppage related to labor contract negotiations during 2020. Management is not aware of circumstances likely to result in a material work stoppage related to contract negotiations with labor unions during 2021.

Our Ability to Attract, Recruit, and Retain Employees

Although we operate in competitive labor markets, we strive to attract, recruit, and retain employees through competitive compensation and benefit programs, learning and development opportunities that support career growth and advancement opportunities, and employee engagement initiatives that foster a strong Company culture.

Competitive Compensation and Benefits. In addition to cash compensation, we offer customary benefits in accordance with local regulatory requirements, and in addition many of our locations offer health and wealth benefits to eligible employees and their dependents which may include, but are not limited to, health insurance, dental and vision plans, retirement savings with matching contributions, and income protection benefits, such as short and long-term disability insurance, life insurance, and paid leave benefits that include vacation, personal time, and holidays. In the U.S., we offer a well-being program which includes counseling, legal and financial consultation, work-life assistance, and crisis intervention services. Additionally, in the U.S. and Canada, our employees are eligible to participate in discount stock purchase plans. We also provide cash and equity incentive programs for key management employees based on our performance. Finally, where applicable, we support the work-life balance of our employees, including part-time jobs, flexible hours, and remote working.

14

PART I

Employee Engagement. At many of our locations, we analyze employee satisfaction and attempt to enhance engagement and mitigate related risks. We periodically conduct employee surveys at certain operations to evaluate the employee relations environment. Voluntary employee turnover data is gathered and analyzed. The results of surveys and data analyses are used to assess human capital risks and identify opportunities for more meaningful employee engagement. From this analysis, action plans are developed, and branch-level initiatives are adopted to improve engagement and reduce turnover. We also engage with our employees through our Ethics Hotline, which serves as a grievance-reporting mechanism. Employees can express concerns, confidentially and anonymously, regarding possible violations of ethics, law, or our policies.

Turnover Rates. We rely on a diverse workforce to sustain our strategies and deliver our results of operations. In order to achieve our goals, this workforce must be stable. In 2020, our voluntary turnover rate in the U.S. was 17.3%, which we believe is reasonably comparable to average voluntary turnover rates of manufacturers in the industries in which we operate.

Our Inclusion, Diversity and Equity

We continue to foster a culture of inclusion, diversity, and equity in which everyone is respected, valued, and has an equal opportunity to contribute, thrive, and advance. Our commitment is unwavering, and we are steadfast in maintaining our focus on building a workforce that represents the many customers we serve and the communities in which we operate around the world.

Fostering an Inclusive and Diverse Culture. Diverse teams generate better ideas and make better decisions. We believe that companies who lead in inclusion and diversity also lead financially. We have created a strategy and action plans designed to foster an inclusive and diverse culture that aligns with our values and priorities.

Inclusion and Diversity Plan. In 2020, we established an inclusion and diversity team comprised of a broad group of employees including senior management. The team established long-term strategies and action plans designed to: (i) ensure that we have a safe and inclusive workplace; (ii) equip our people to attract, develop, retain, and reward a diverse and inclusive workforce; (iii) be an inclusive and equitable corporate citizen; (iv) develop a governance and accountability model that will sustain inclusion and diversity; and (v) enhance our business results.

Equal Opportunity. We are committed to equal opportunity and base workplace decisions solely on merit, qualifications, and other job-related, neutral, non-discriminatory criteria. We provide equal employment opportunity without regard to age, race, color, sex, sexual orientation, gender identity, national origin, citizenship, pregnancy, religion, disability, military status, genetic information, or other status protected by law. We are committed to providing a harassment-free work environment, and we prohibit retaliation, intimidation, threats, coercion, or discrimination against individuals who, in good faith, complain of unlawful discrimination or harassment.

Our Workforce Health and Safety

Workforce Health. We are focused on protecting our employees against COVID-19 and ensuring a healthy work environment. To respond to COVID-19, we formed a cross-functional crisis response team. Our business leaders manage items such as developing health and safety protocols, responding to health and safety issues, interpreting government orders, and securing personal protective equipment. We developed a comprehensive handbook to set and communicate work procedures and changes to production necessary to facilitate COVID-19 health and safety measures, including proper social distancing. Our business leaders have implemented training and change management initiatives to drive and maintain new ways of operating. When employees test positive for COVID-19, we follow adopted procedures including enhanced disinfecting that targets applicable areas. The affected employee is required to observe a quarantine period, monitor symptoms, and follow medical guidance prior to returning to work. Contact tracing is performed to identify employees who had direct contact with the affected employee. If direct contacts are identified, those employees must self-isolate, monitor symptoms, and follow medical guidance prior to returning to work.

Workplace Safety. We are also dedicated to the safety of our employees through prevention, education, and awareness with the objective of reducing, or even eliminating, workplace injuries through accident investigation and process safety. Our dedicated staff of professionals supports safety management at our manufacturing facilities, including implementation of a comprehensive program called “SafeGuard.” The SafeGuard program develops relevant job hazard analyses, which are

15

PART I

undertaken on many processes and used to develop comprehensive job procedures. This allows us to implement job-specific health and safety practices across our business.

Continuing Education and Training

Developing Our Talent. Although some of our established learning and development programs, as disclosed below, were less active during 2020 due to the impact of the COVID-19 pandemic, they continue to be part of our ongoing, long-term strategy, which is focused on growing talent throughout all levels of our organization, including technical/skilled positions, supervisory and management levels, and future leaders.

Frontline Supervisor Training Program. We have launched a global Frontline Supervisor Training Program designed to help managers at branch locations develop leadership skills necessary to enhance strong employee engagement. The program stresses communication, conflict resolution, respect in the workplace, and safety.

Intern Program. We have also developed an intern program that is centered on students exploring a future with us, and our attracting a deep and diverse talent pool that can grow with us from intern to entry-level hire.

Health and Safety Training. Our manufacturing employees receive new hire safety training, annual refresher safety training, weekly “tool box” talks regarding safety and training, and job-specific safety training based on the jobs hazards analysis developed from our SafeGuard program.

Succession Development

Management and Leadership Positions. Our commitment to having strong managers and leadership in critical roles across the company continues to serve us well. Our values and culture guide our talent initiatives which are designed to create a pipeline of strong, high performing leadership candidates to serve in progressively important roles throughout the Company. Our internal promotion rate over the last three years for corporate officer positions was 89%. We are building on our success in these areas and continue to push our succession development processes to new levels to allow us to adapt and grow.

Trends in Market Demand and Competition

Demand Trends for our Products. Because of the COVID-19 pandemic, various governments in Asia, Europe, North America, and elsewhere have instituted, and may reinstitute, quarantines, shelter-in-place or stay-at-home orders, or restrictions on public gatherings, as well as limitations on social interactions. The resulting economic downturn has had, and could further have, an effect on the demand for our products and our customers’ products, growth rates in the industries in which we participate, and opportunities in these industries. The impact of the COVID-19 pandemic began in January 2020, directly affecting our operations in China, as well as the global supply chain. The crisis accelerated, impacting virtually all geographies by mid-March. By mid-second quarter 2020, we began to see rapid recovery in businesses serving home-related markets. With consumers spending less on travel and entertainment, they began investing more in their homes. This benefited our Bedding, Home Furniture, Flooring, and Textiles businesses. We ended 2020 with fourth quarter sales in many of our businesses above fourth quarter 2019 levels.

Competition. Many companies offer products that compete with those we manufacture and sell. The number of competing companies varies by product family, but many of the markets for our products are highly competitive. We tend to attract and retain customers through innovation, product quality, competitive pricing, and customer service. Many of our competitors try to win business primarily on price, but, depending upon the particular product, we experience competition based on quality and performance as well. In general, our competitors tend to be smaller, private companies.

16

PART I

We believe we are the largest U.S.-based manufacturer, in terms of revenue, of the following:

| • | Bedding components | ||||

| • | Automotive seat support and lumbar systems | ||||

| • | Specialty bedding foams and private label finished mattresses | ||||

| • | Components for home furniture and work furniture | ||||

| • | Flooring underlayment | ||||

| • | Adjustable beds | ||||

| • | Bedding industry machinery | ||||

We continue to face competitive pressure as some of our customers source a portion of their components and finished products from low cost countries. In addition to lower labor rates, competitors may benefit at times from lower raw material costs. They may also benefit from currency factors and more lenient regulatory climates. We typically remain price competitive, even versus many foreign manufacturers, as a result of our efficient operations, automation, vertical integration in steel and wire, logistics and distribution efficiencies, and large scale purchasing of raw materials and commodities.

For information about antidumping duty orders regarding innerspring, steel wire rod, and mattress imports, please see "Competition" in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations on page 39.

Seasonality

As a diversified manufacturer, we generally have not experienced significant seasonality. However, unusual economic factors in any given year such as inflation and deflation, along with acquisitions and divestitures, can create sales variability and obscure the underlying seasonality of our businesses. Historically, our operating cash flows are stronger in the fourth quarter, primarily related to the timing of cash collections from customers and payments to vendors.

Governmental Regulations

Our operations are subject to various federal, state, local, and international laws and regulations, including environmental regulations. We have policies intended to ensure that our operations are conducted in compliance with applicable laws and regulations. While we cannot predict policy changes by various regulatory agencies or unexpected operational or other developments, management expects that compliance with these laws and regulations will not have a material adverse effect on our capital expenditures (including those capital expenditures for environmental control facilities), earnings, and competitive position.

Internet Access to Information

We routinely post information for investors under the Investor Relations section of our website (www.leggett.com). Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are made available, free of charge, on our website as soon as reasonably practicable after electronically filed with, or furnished to, the SEC. In addition to these reports, the Company’s Financial Code of Ethics, Code of Business Conduct and Ethics, and Corporate Governance Guidelines, as well as charters for the Audit, Compensation, and Nominating & Corporate Governance Committees of our Board of Directors, can be found on our website under the Corporate Governance section. Information contained on our website does not constitute part of this Annual Report on Form 10-K.

17

PART I

Industry and Market Data

Unless indicated otherwise, the information concerning our industries contained in this Annual Report is based on our general knowledge of and expectations concerning the industries. Our market share is based on estimates using our internal data, data from various industry analyses, internal research, and adjustments and assumptions that we believe to be reasonable. We have not independently verified data from industry analyses and cannot guarantee their accuracy or completeness.

Item 1A. Risk Factors.

Investing in our securities involves risk. Set forth below and elsewhere in this report are risk factors that could cause actual results to differ materially from the results contemplated by the forward-looking statements contained in this report. We may amend or supplement these risk factors from time to time by other reports we file with the SEC.

OPERATIONAL RISK FACTORS

The COVID-19 pandemic has had, and could further have, an adverse impact to (i) our manufacturing operations' ability to remain open, or fully operate, (ii) our ability to obtain necessary raw materials and parts, maintain appropriate labor levels, and ship finished products to customers; and (iii) our operating costs related to pay and benefits for terminated employees; all of which, in the aggregate, have had, and could further have, a material negative impact on our trade sales, earnings, liquidity, cash flow, financial condition, and our stock price.

We have manufacturing facilities in the United States and 16 other countries. All of these countries have been affected by the COVID-19 pandemic. All of our facilities are open and running at this time. From time to time we have some capacity restrictions on our plants due to governmental orders in various parts of the world. We have been and could be further negatively affected by governmental action in any one or more of the countries in which we operate by the imposition, or re-imposition, of restrictive measures concerning shelter-in-place or stay-at-home orders, public gatherings and human interactions, mandatory closures of retail establishments that sell our products or our customers’ products, travel restrictions, and restrictions on the import or export of products.

The U.S. and other governments have ordered that certain nonwoven fabrics used to produce ComfortCore® innersprings be prioritized to produce medical supplies, resulting in shortages of fabrics used for non-medical applications. These shortages and strong bedding demand have caused the Company temporarily to be unable to supply full industry demand for ComfortCore®. We are engaging with customers in an effort to work through these issues. The shortages have resulted in higher pricing for nonwoven fabrics. If we are unable to obtain the fabrics, cannot pass the cost along to our customers, are required to modify existing contracts to accommodate customers, or pay damage claims to customers, our results of operations may be negatively impacted. As demand has improved, we also have experienced some temporary labor shortages. We are in the process of hiring additional employees and adding equipment, particularly in our U.S. Spring business, to meet this demand.

Because of the shift of production by semiconductor microchip manufacturers to consumer electronics, such as laptops and tablets for home schooling and home offices, and away from automotive applications during the COVID-19 related automotive industry shutdowns in 2020, currently there is a shortage of microchips in the automotive industry. Our Automotive Group uses the microchips in seat comfort products, and to a lesser extent in motors and actuators. Although, to date, our Automotive Group has been able to obtain an adequate supply of microchips, we are dependent on our suppliers to deliver these microchips in accordance with our production schedule, and a shortage of the microchips can disrupt our operations and our ability to deliver products to our customers. Also, because of the industry shortage, automotive OEMs and other suppliers have not been able to secure an adequate supply of microchips, and as a result have reduced their production of automobiles or parts, which in turn has recently reduced, and may continue to reduce our sale of products. If we cannot secure an adequate supply of microchips in our supply chain, and the microchips cannot be sourced from a different supplier, or the automotive OEMs and other suppliers continue to reduce their production as a result of such shortage, this may negatively impact our sales, earnings, and financial condition.

18

PART I

Depending on the length and severity of the COVID-19 pandemic, and the timing and effectiveness of any vaccines, our ability to keep our manufacturing operations open or fully operational, build and maintain appropriate labor levels, obtain necessary raw materials and parts, and ship finished products to customers may be partially or completely disrupted, either on a temporary or prolonged basis. The continued realization of these risks to our manufacturing operations, labor force, and supply chain could also increase labor, commodity, and energy costs.

Also, some facilities have experienced problems delivering products to customers because of travel restrictions and disruption in logistics necessary to import, export, or transfer products across borders. Currently, our supply chains have also been hampered by congested ports.

When our employees have tested positive for COVID-19, we follow governmental orders and internally adopted procedures which include enhanced disinfecting that targets areas that have likely exposure to COVID-19. The employee is required to observe a quarantine period, monitor symptoms, and follow medical guidance prior to returning to work. Contact tracing is performed to identify any other employees who had direct contact with the employee who tested positive for COVID-19. If any direct contacts are identified, those employees must also self-isolate, monitor symptoms, and follow medical guidance prior to returning to work. A significant increase in COVID-19 cases among our employees may disrupt our ability to maintain necessary labor levels and produce and deliver products to our customers if we are unable to shift production to other manufacturing facilities.

In connection with reduced demand for our products in certain business units, we decreased the size of our workforce worldwide. We incurred severance costs of $7 million in 2020 and we do not expect any additional material charges. However, if circumstances change because of lack of demand, additional governmental capacity restrictions related to our facilities or otherwise, we may incur future material separation costs.

Business disruptions to our steel rod mill, if coupled with an inability to purchase an adequate and/or timely supply of quality steel rod from alternative sources, could have a material negative impact on our Bedding Products segment and Company results of operations.

We purchase steel scrap from third party suppliers. This scrap is converted into steel rod in our mill in Sterling, Illinois. Our steel rod mill has historically had annual output of approximately 500,000 tons, a substantial majority of which has been used internally by our wire mills, which convert the steel rod into drawn steel wire. This wire is used in the production of many of our products, including mattress innersprings.

A disruption to the operation of, or supply of steel scrap to, our steel rod mill could require us to purchase steel rod from alternative supply sources, subject to market availability. Ongoing trade action by the United States government, along with the existence of antidumping and countervailing duty orders against multiple countries, could result in reduced market availability and/or higher cost of steel rod.

If we experience a disruption to our ability to produce steel rod in our mill, coupled with a reduction of adequate and/or timely supply from alternative market sources of quality steel rod, we could experience a material negative impact on our Bedding Products segment and the Company's results of operations.

FINANCIAL RISK FACTORS

The COVID-19 pandemic has had, and could further have, an adverse impact on the collection of trade and other notes receivables in accordance with their terms due to customer bankruptcy, financial difficulties, or insolvency.

Bankruptcy, financial difficulties, or insolvency caused by the COVID-19 pandemic, or otherwise, can and has occurred with some of our customers which can impact their ability to pay their debts to us. As of December 31, 2020, we had a $25 million allowance for doubtful accounts ($23 million on a note receivable and $2 million on trade accounts receivable) associated with a customer in our Bedding Products segment who is experiencing financial difficulty and liquidity problems. This customer was placed on nonaccrual status in 2018 and became delinquent in quarterly interest payments in the first quarter of 2020.

In addition to the customer referenced above, many of our customers and other third parties have been adversely affected by the social and governmental restrictions and limitations related to the COVID-19 pandemic. As such, we

19

PART I

increased our allowance for doubtful accounts by $20 million in the first quarter of 2020, including $9 million for the customer referenced above. We had modest activity for the remainder of 2020, and our bad debt expense for the year ended December 31, 2020 was $17 million. If these parties suffer significant financial difficulty, they may be unable to pay their debts to us, they may reject their contractual obligations to us under bankruptcy laws or otherwise, or we may have to negotiate significant discounts and/or extend financing terms with these parties. If we are unable to collect trade receivables and other notes receivables on a timely basis, this inability will require additional provisions for bad debt and result in a negative impact on our earnings, liquidity, cash flow and financial condition.

Our goodwill and other long-lived assets are subject to potential impairment which could negatively impact our earnings.

A significant portion of our assets consists of goodwill and other long-lived assets, the carrying value of which may be reduced if we determine that those assets are impaired. At December 31, 2020, goodwill and other intangible assets represented $2.1 billion, or 44% of our total assets. In addition, net property, plant, and equipment, operating lease right-of-use assets, and sundry assets totaled $1.1 billion, or 22% of total assets.

We review our reporting units for potential goodwill impairment in the second quarter as part of our annual goodwill impairment testing, and more often if an event or circumstance occurs making it likely that impairment exists. In addition, we test for the recoverability of long-lived assets at year end, and more often if an event or circumstance indicates the carrying value may not be recoverable. We conduct impairment testing based on our current business strategy in light of present industry and economic conditions, as well as future expectations.

The 2020 goodwill impairment testing resulted in a $25 million non-cash goodwill impairment charge in the second quarter of 2020 with respect to our Hydraulic Cylinders reporting unit, which is a part of the Specialized Products segment. Demand for hydraulic cylinders is dependent upon capital spending for material handling equipment.

The impairment charge reflects the complete write-off of the goodwill associated with the Hydraulic Cylinders reporting unit and will not result in future cash expenditures. Although we do not believe that a triggering event related to the impairment of goodwill or other long-lived assets occurred in the first quarter of 2020, the anticipated longer-term economic impacts of COVID-19 lowered expectations of future revenue and profitability causing its fair value to fall below its carrying value. We concluded on July 30, 2020, as part of our normal second quarter 2020 annual goodwill impairment testing and in connection with the preparation and review of the second quarter 2020 financial statements, that an impairment charge was required with respect to this reporting unit. We also evaluated other long-lived assets associated with this unit for impairment; no impairments were indicated other than goodwill.

Of the remaining six reporting units, three had fair values in excess of carrying value of less than 100%.

• Fair value for our Bedding reporting unit exceeded carrying value by 68%. Our 2019 acquisition of ECS is part of our Bedding reporting unit, and goodwill for our Bedding reporting unit was $857 million at December 31, 2020.

• Fair value for our Aerospace reporting unit exceeded carrying value by 51%. Goodwill for the Aerospace reporting unit was $59 million at December 31, 2020.

• Fair value for our Work Furniture reporting unit exceeded carrying value by 25%. Goodwill for the Work Furniture reporting unit was $97 million at December 31, 2020.

If there is a prolonged adverse economic impact from the COVID-19 pandemic, or otherwise, we may not be able to achieve projected performance levels. Although we do not believe that a triggering event has occurred, internal forecasts and industry data suggest that economic impacts of COVID-19 for the aerospace industry may be longer than previously expected during the second quarter impairment testing. We are continuing to monitor all factors impacting this industry. If actual results materially differ from the assumptions and estimates used in the goodwill and long-lived asset valuation calculations, we could incur future impairment charges. These non-cash charges could have a material negative impact on our earnings.

For more information regarding potential goodwill and other long-lived asset impairment, please refer to Note C on page 90 of the Notes to Consolidated Financial Statements.

20

PART I

The COVID-19 pandemic could have an adverse impact to our ability to access the commercial paper market, and has had, and could further have, an adverse impact on our ability to borrow under our credit facility, including our ability to comply with the restrictive covenants in our credit facility.

The COVID-19 pandemic could have an adverse impact on our liquidity. Our inability to issue commercial paper in appropriate amounts and tenor, for cash management purposes, could cause us to borrow under our revolving credit facility which serves as support for our commercial paper program. If this were to happen, we would incur higher interest costs.

The credit facility is a multi-currency facility maturing in January 2024, providing us the ability, from time to time subject to certain restrictive covenants and customary conditions, to borrow, repay, and re-borrow up to $1.2 billion. The credit facility also provided for a one-time draw of up to $500 million under a five-year term loan facility, which we fully borrowed in January 2019 to consummate the ECS acquisition.

Because of the economic impacts of the COVID-19 pandemic on our business, effective May 6, 2020, we amended the credit facility to, among other things, change the restrictive borrowing covenants. The prior leverage ratio covenant required us to maintain, as of the last day of each quarter, a leverage ratio of consolidated funded indebtedness to trailing 12-month consolidated EBITDA (each as defined in the credit facility) of not greater than 3.50 to 1.00. The leverage ratio covenant was changed in two ways: (i) the calculation of the ratio now subtracts unrestricted cash (as defined in the credit facility) from consolidated funded indebtedness; and (ii) the ratio levels, calculated as of the last day of the applicable fiscal quarter, were changed to 4.75 to 1.00 for each fiscal quarter end date through March 31, 2021; 4.25 to 1.00 at June 30, 2021; 3.75 to 1.00 at September 30, 2021; and 3.25 to 1.00 at December 31, 2021 and thereafter. In addition, the amount of total secured debt limit was changed from 15% to 5% of our total consolidated assets until December 31, 2021, at which time it will revert back to 15%. Various interest rate terms were also changed. The impact on our interest expense will depend upon our ability to access the commercial paper market, and if so, the degree of that access. The credit facility also contains an anti-cash hoarding provision that limits borrowing if the Company has a consolidated cash balance (as defined in the credit facility) in excess of $300 million without planned expenditures.

If our earnings are reduced because of the COVID-19 pandemic or otherwise, the covenants in the credit facility will reduce our borrowing capacity, both under the credit facility or through commercial paper issuances. Depending on the degree of earnings reduction, our liquidity could be materially negatively impacted. This covenant may also restrict our current and future operations, including (i) our flexibility to plan for, or react to, changes in our businesses and industries; and (ii) our ability to use our cash flows, or obtain additional financing, for future working capital, capital expenditures, acquisitions, or other general corporate purposes.

Also, if we fail to comply with the covenants specified in the credit facility, we may trigger an event of default, in which case the lenders would have the right to: (i) terminate their commitment to provide additional loans under the credit facility; and (ii) declare all borrowings outstanding, together with accrued and unpaid interest and fees, to be immediately due and payable. Additionally, our senior notes contain cross-default provisions which could make outstanding amounts under the senior notes immediately payable in the event of an acceleration of amounts due under the credit facility following a material uncured default. If debt under the credit facility or senior notes were to be accelerated, we may not have sufficient cash to repay this debt, which would have an immediate material adverse effect on our business, results of operations, and financial condition.

We may not be able to realize deferred tax assets on our balance sheet depending upon the amount and source of future taxable income.

Our ability to realize deferred tax assets on our balance sheet is dependent upon the amount and source of future taxable income. As of December 31, 2020, we had $134 million of deferred tax assets ($152 million less an $18 million valuation allowance). After netting of deferred tax liabilities, the net amount presented within Sundry assets on our Consolidated Balance Sheets is $11 million. It is possible the amount and source of our taxable income could materially change in the future. Particularly, our mix of earnings by taxing jurisdiction may materially change in that we may have more or less taxable income generated in North America, Europe, or Asia as compared to prior years. This change may impact our underlying assumptions on which valuation allowances are established and negatively affect future period earnings and balance sheets. As a result, we may not be able to realize deferred tax assets on our balance sheet.

21

PART I

MARKET RISK FACTORS

Costs of raw materials could negatively affect our profit margins and earnings.

Raw material cost increases (and our ability to respond to cost increases through selling price increases) can significantly impact our earnings. We typically have short-term commitments from our suppliers; accordingly, our raw material costs generally move with the market. When we experience significant increases in raw material costs, we typically implement price increases to recover the higher costs. Inability to recover cost increases (or a delay in the recovery time) can negatively impact our earnings. Conversely, if raw material costs decrease, we generally pass through reduced selling prices to our customers. Reduced selling prices combined with higher cost inventory can reduce our profit margins and earnings.

Steel is our principal raw material. The global steel markets are cyclical in nature and have been volatile in recent years. This volatility can result in large swings in pricing and margins from year to year.

As a producer of steel rod, we are also impacted by volatility in metal margins (the difference between the cost of steel scrap and the market price for steel rod). If market conditions cause scrap costs and rod pricing to change at different rates (both in terms of timing and amount), metal margins could be compressed, and this would negatively impact our results of operations.

With the acquisition of ECS, we now have greater exposure to the cost of chemicals, including TDI, MDI, and polyol. We have experienced a shortage of chemicals, and these shortages have resulted in higher pricing. Chemical shortages are expected to continue at least through mid-2021. If we are unable to obtain an adequate supply of chemicals, or cannot purchase them at economically feasible prices and pass the additional cost along to our customers, either the shortages or increased costs may negatively impact our results of operations.