Fellow Shareholders,

Leggett & Platt achieved several milestones in 2021. We attained record sales1 and EPS, increased our dividend for the 50th consecutive year, announced the transition to a new CEO, and issued our inaugural sustainability report.

We also promoted long-tenured employees to key leadership positions and filled several newly created positions to bolster our human capital management, as well as our ID&E and ESG efforts. These achievements would not be possible without

our 20,000 employees, who are dedicated to creating innovative, sustainable products for our customers, ensuring a safe and inclusive workplace, and driving value for our shareholders.

2021 Performance

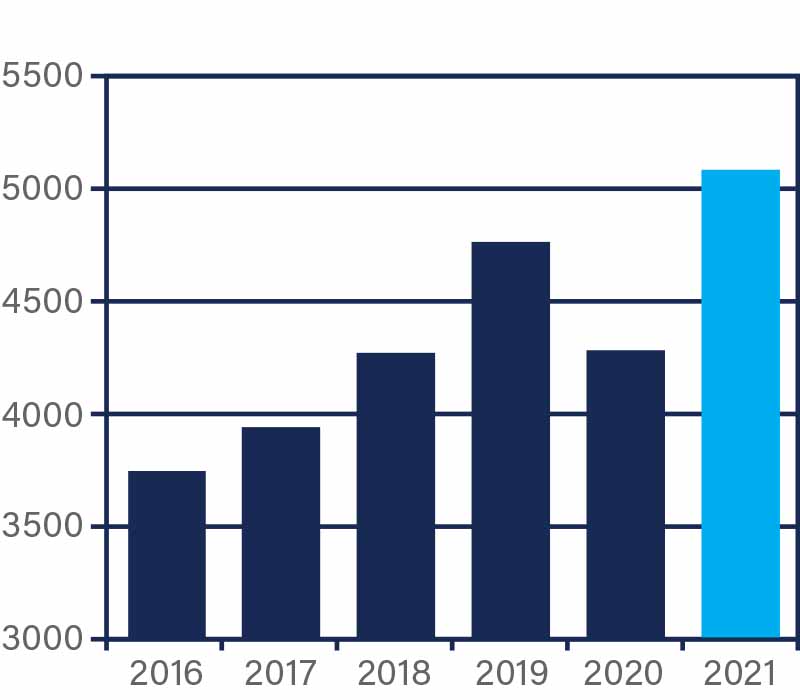

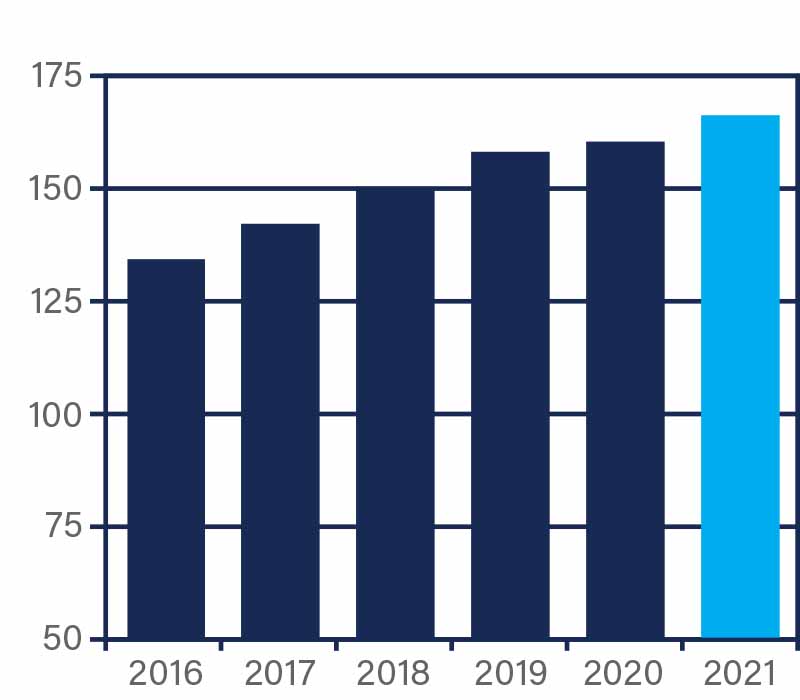

Sales grew 19% in 2021, to a record1 $5.1 billion. Organic sales increased 18%, primarily from raw material-related selling price increases of 13%, volume recovery from pandemic-related sales declines in 2020 of 4%, and currency

benefit of 1%. Acquisitions, net of divestitures, added 1% to sales growth. While most of our businesses recovered from the pandemic-related impacts of 2020, many experienced supply chain issues related to raw material shortages, labor

availability, and transportation challenges at various points throughout the year.

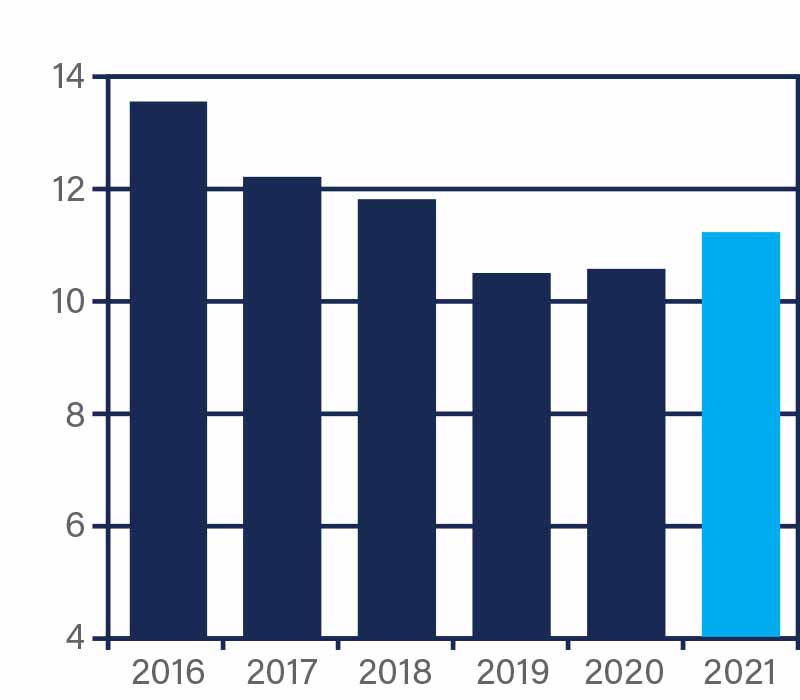

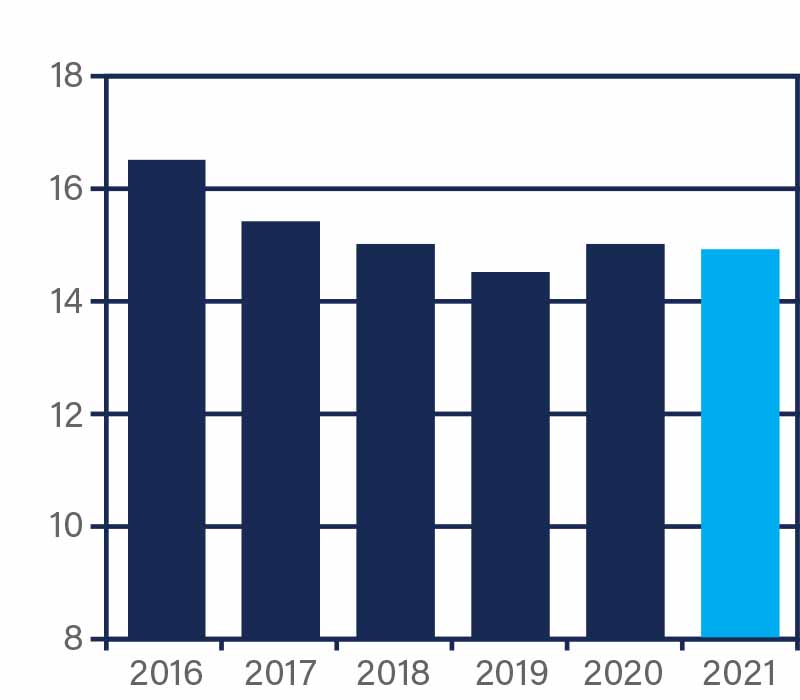

EBIT increased $188 million, and adjusted2 EBIT increased $115 million. Earnings benefited primarily from higher volume, metal margin expansion in our Steel Rod business, and pricing discipline. EBIT margin was 11.7% and adjusted2 EBIT margin was 11.2%, up from 2020’s adjusted2 EBIT margin of 10.6%. EBITDA2 margin was 15.4% and adjusted EBITDA2 margin was 14.9%, down from 2020’s adjusted EBITDA2 margin of 15.0%.

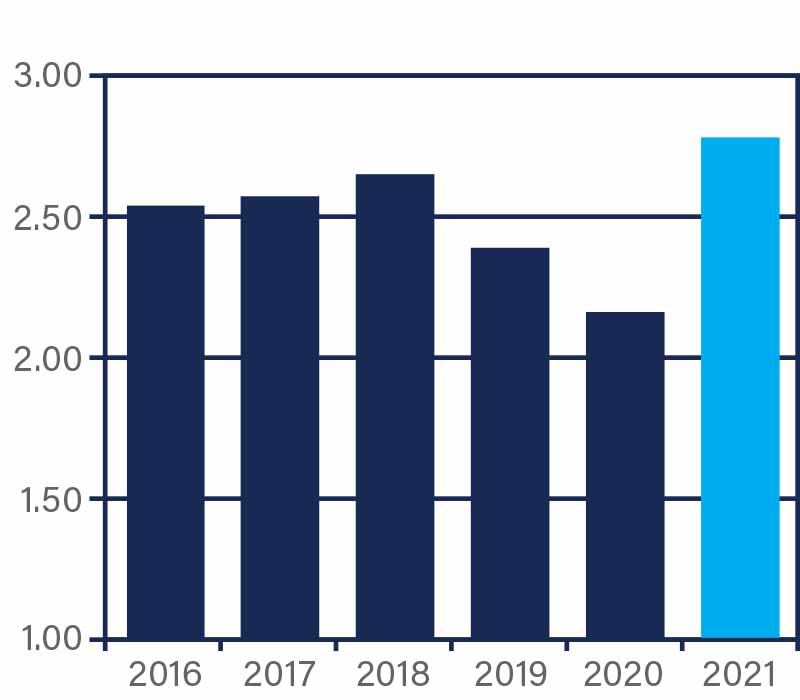

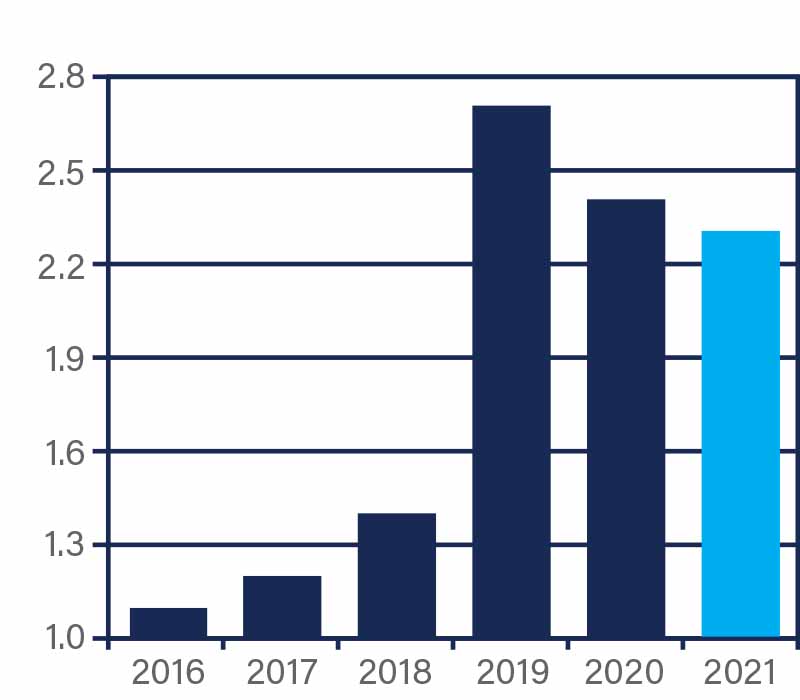

Earnings per share in 2021 were a record $2.94, including a $.16 per share gain on the sale of real estate associated with our exited Fashion Bed business, an increase of 58% versus EPS of $1.86 in 2020. Adjusted2 EPS was a

record $2.78, an increase of 29% versus adjusted2 EPS of $2.16 in 2020.3

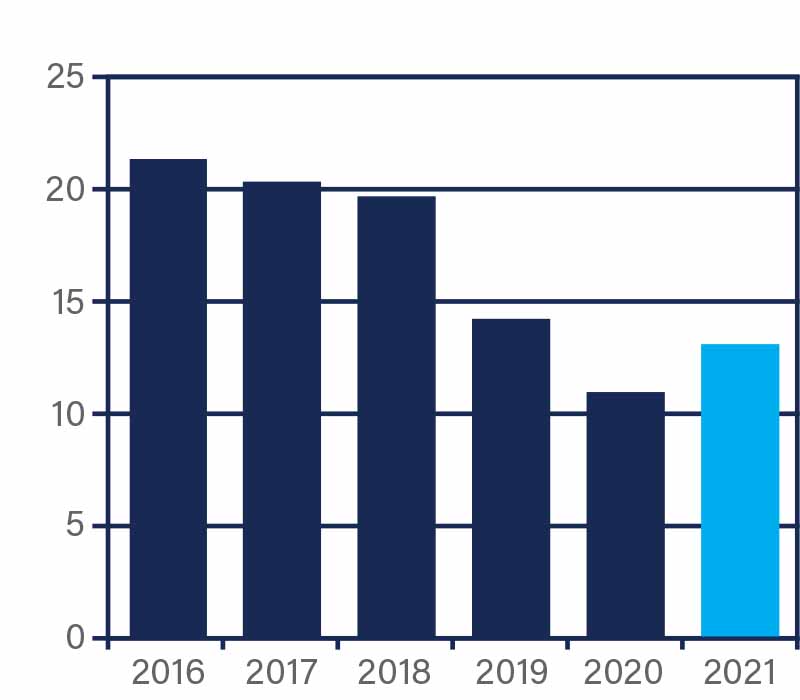

50 Years of Annual Dividend Increases

We raised our annual dividend for the 50th consecutive year in 2021, honoring our ongoing commitment to return value to our shareholders. As a result of this commitment over many decades, we are now a member of a select group

of companies referred to as Dividend Kings.

In May, we increased our quarterly dividend by $.02, or 5%, to $.42 per share. Dividends generated a 4.1% yield for investors based on the December 31, 2021 closing price of $41.16, one of the highest yields among the companies that comprise

the Dividend Kings.

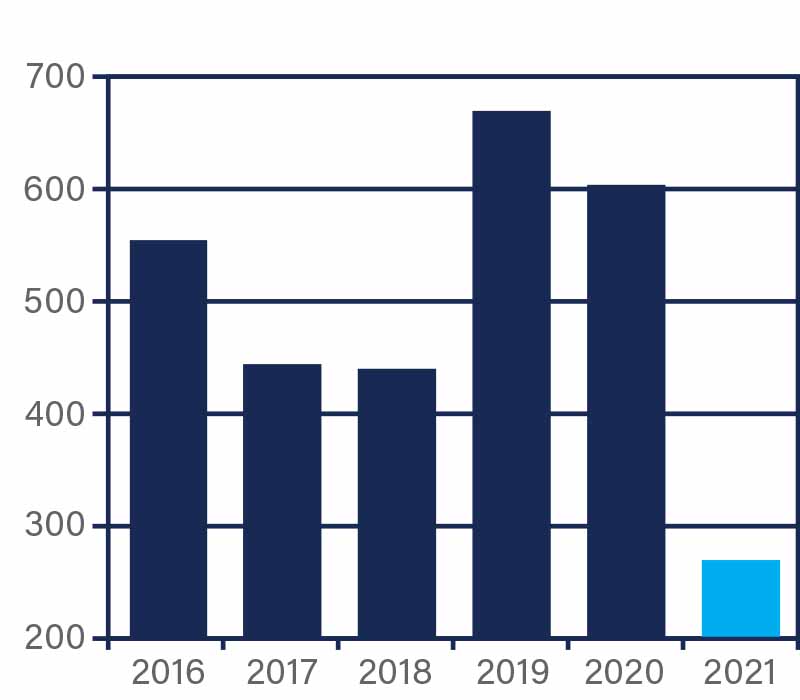

Sources and Uses of Cash

We generated $271 million of cash from operations during 2021. Operating cash flow was lower in 2021 primarily from inflationary impacts and planned working capital investments to rebuild inventory in our Steel Rod, Drawn Wire, and U.S.

Spring businesses following severe depletion in 2020. We also brought back offshore cash totaling $247 million.

Our long-term priorities for use of cash are unchanged. They include, in order of priority, funding organic growth, paying dividends, funding strategic acquisitions, and share repurchases with available cash. Major uses of cash in 2021

were consistent with those priorities: they included $107 million for capital expenditures, $218 million for dividend payments, and $153 million for acquisitions.

In November, we issued $500 million of 30-year, 3.5% notes, and used some of the proceeds to repay outstanding commercial paper. We ended 2021 with net debt to trailing 12-months adjusted EBITDA2 of 2.29x.

We remain focused on cash generation while reducing debt and deploying capital in a balanced and disciplined manner that positions us to capture near- and long-term growth opportunities both organically and through strategic acquisitions.

Strategy and Growth

Our long-term focus is to grow earnings and allocate capital appropriately. We screen investments (both organic and acquisition) with a profitable growth lens as well as a view on strategic and cultural fit. We routinely evaluate our portfolio

and take action to improve or exit businesses that fail to generate acceptable returns and margins. If we do not find investments that create economic value (returns above WACC) then we return excess cash to shareholders through share

repurchases.

We have a long-standing commitment to dividend growth and investment grade debt ratings that we greatly value. Our strong balance sheet and cash flow allow us to support these commitments and take advantage of attractive investment opportunities.

Total Shareholder Return, or TSR4, is the primary financial measure that we use to assess long-term performance. We target average annual TSR of 11–14% through an approach that employs four TSR sources: revenue growth, margin

expansion, dividends, and share repurchases.

Our TSR framework targets long-term revenue growth of 6–9%. We expect to achieve the growth target through a combination of sources, including:

- Increasing content and new programs, particularly in our Bedding and Specialized Products segments,

- Expanding our addressable markets, as we’ve done with the acquisitions of ECS and Kayfoam in Bedding and through the expansion of convenience features in our Automotive business, and

- Identifying strategic acquisitions that complement our current products or capabilities.

Long-term sustainable EBIT margins should be in the range of 11.5–12.5%. Through the efforts of our employees, we have maintained the majority of the fixed cost reductions taken in 2020. As our businesses recovered from the economic downturn

driven by the pandemic, we returned to considering investments necessary to support higher volume and future growth opportunities. We also expect margins to benefit from higher volume and less disruption as supply chain constraints

improve. Longer term, we expect margin expansion from ongoing portfolio management, innovation from new products, growth in attractive markets such as Bedding and Automotive, and continuous improvement activity across our businesses.

Progress Through Our People

In a seamless and long-planned transition, Mitch Dolloff became Leggett’s CEO on January 1, 2022. Mitch joined the Company in 2000 in the Mergers & Acquisitions department, transitioned to operations, and has successfully led various of

our operations over the past two decades, including our global Automotive business, and more recently, our global Bedding business. Mitch transitioned to COO in 2019 and joined the Board of Directors in 2020.

Karl Glassman retired as Leggett’s CEO on December 31, 2021. Karl joined the Company in 1982, has long been one of Leggett’s key executives, and served as CEO since 2016. He continues to provide counsel as Executive Chairman, serving as

an advisor to Mitch and leading the Board of Directors.

We also promoted two long-tenured employees to lead two of our key businesses, Bedding and Automotive. These highly capable leaders, along with their teams, will continue to build upon the value creation these two businesses have provided

and create a bright future as they strive to advance innovative, sustainable solutions for their customers and ultimately the end consumer.

In April 2021, we issued our inaugural sustainability report to provide our stakeholders with a better understanding of our business practices as they relate to Environmental, Social, and Governance (ESG) matters. We have long recognized

the importance of these practices as they have been aligned with our values over many decades, but as with all of our business processes, we are always looking for improvement opportunities. During 2021, we added newly created positions,

including our first Chief Human Resources Officer, ID&E Director, and Sustainability Manager to help lead and evaluate our ESG business practices and activities.

The continued success of this Company is built upon the culture and values of the 20,000 employees that come to work every day, and we could not be prouder to be on their team. Thank you to our employees for making Leggett & Platt the

company it is today and helping to shape its future – a future we are very excited about. Finally, we want to thank our customers, suppliers, and investors for your support and commitment.

Mitch Dolloff

President and CEO

February 22, 2022

Karl Glassman

Executive Chairman

February 22, 2022